georgia film tax credit history

An additional 10 credit can be obtained if the finished project. Minimum expenditure threshold can be met with one project or the total of multiple projects aggregated in.

Georgia Tax Breaks Don T Deliver Georgia Budget And Policy Institute

In return Georgia realized only 65 million in net new revenue meaning the state self-inflicted a net revenue loss of 602 million.

. Television films pilots or series. The 30 percent tax. On August 4 2020 Georgia Governor Brian Kemp signed House Bill 1037 HB 1037 which outlines several changes including a new application process mandatory audits timing of credit issuance and eligibility modifications.

Although Georgia provides an incredible Georgia film tax credit the pairing of both the state of Georgia and EUE Screen Gems makes for top quality productions with a low bearing cost making the 2 a great deal found. The state of Georgia has recorded its highest mark ever for giving out its film and TV tax credit for eligible productions. A Base Certification Application may be submitted within 90 days of the start of principal photography.

EUE Screen Gems offers a 6 decade history of making film television and also commercial projects of the best quality. Tax The Georgia film credit can offset Georgia state income tax. Projects first certified by DECD on or after 1.

About the Film Tax Credit First passed in 2005 Georgias film tax credit provides an income tax credit to production companies that spend at least 500000 on qualified productions. This is an easy way to reduce your Georgia tax liability. A Georgia taxpayer may purchase Georgia Entertainment Credits generally for around 88 per credit and apply them to their current year or future tax.

Credit Code 122 company name is the movie company no certificate 100 owner Federal EIN No and Credit Amount. In 2016 Georgia granted 667 million in tax credits for film productions. On average 1 of Georgia Film Tax credit can be purchased for 087 to 090.

Although there have been a lot of revisions to the original. Since its passage in 2008 the Georgia Entertainment Industry Investment Act the Act has become widely known and the tax credits it creates called film credits have led to the growth of the film industry in Georgia. GA Film Tax Credit - List of Expenditures final 12-14-18pdf 3015 KB.

More than the state spends on child welfare or state prisons or public health. Georgia doled out a record 12 billion in film and TV tax credits last year far surpassing the incentives offered by any. The Georgia Entertainment Industry Investment Act provides the largest tax credit offered by Georgia and it is the most generous film incentive program in the nation with an.

The mandatory film tax credit audit is based on the date the production was first certified by the Department of Economic Development DECD and the credit amount according to the following schedule. Includes a promotional logo provided by the state. This is an easy way to reduce your Georgia tax liability.

Claim Withholding reported on the G2-FP and the G2-FL. The Governors Office of Planning and Budget reported. My answer from 2 years ago is probably still valid and copied here.

Exploring Georgias Film Industry Tax Credits Series 0. Georgia is a production-friendly state with transferable film tax credits up to 30 of qualified expenditures. Companies for services performed in Georgia when getting the Georgia Film Tax Credit.

Production companies are required to withhold 6 Georgia income tax on all payments to loan-out. Most of the credits are purchase for 87-92 of their face value. By News on November 9 2016 Features.

Losing 90 cents on the dollar. Register for a Withholding Film Tax Account. 30 2022 at 352 PM PDT.

GEORGIA FILM TAX CREDIT For a project to be eligible for the 20 base transferable tax credit the Georgia Department of Economic Development must certify the project. Certification for live action projects will be through the Georgia Film Office. And music videos that are distributed outside of Georgia.

In 2013 the direct investment in the State of Georgia attributable to the Act exceeded 1 billion with a resulting economic impact of approximately. The audit is requested through the Georgia Department of Revenue website GDOR and. The Georgia Department of Revenue GDOR offers a voluntary program.

Even amid the pandemic the state reported that 234 movies and TV shows filmed there during the 2020 fiscal year. GEIIA also known as the film tax credit passed in 2005. Georgias film tax credit is unique because it has no cap and is transferable.

Qualifying Projects 20 tax credit is provided for companies that spend 500K or more on production and post production in Georgia. For example you could purchase 20000 of 2017 Georgia Entertainment Credits for 17400 resulting in an immediate savings of 2600. The income bill passed out the Senate.

An audit is required prior to utilization or transfer of any earned Georgia film tax credit that exceeds 25 million in 2021 125 million in 2022 and for any credit amount thereafter. Third Party Bulk Filers add Access to a Withholding Film Tax Account. The industry in Georgia was boosted substantially by tax incentives.

Georgias film tax credit is massive. How to File a Withholding Film Tax Return. This 50000 would apply to current year or prior year taxes owed and any remaining amount.

So for example if you had a Georgia income tax liability of 50000 you could purchase enough credits at 89 of there value that would equal 44500. In 2019 Georgia gave out 850 million in credits. Transferability means more than just film companies benefit from the tax credits.

Projects first certified by DECD on or after 1121 with credit amount that exceeds 250000000. Some Georgia film tax incentives include. Most of the credits are purchase for 87-92 of their face value.

Instructions for Production Companies. This 50000 would apply to current year or prior year taxes owed and any remaining amount could be carried over up to five years. The states first tax incentive was a point of purchase sales and use tax exemption first introduced in 2002.

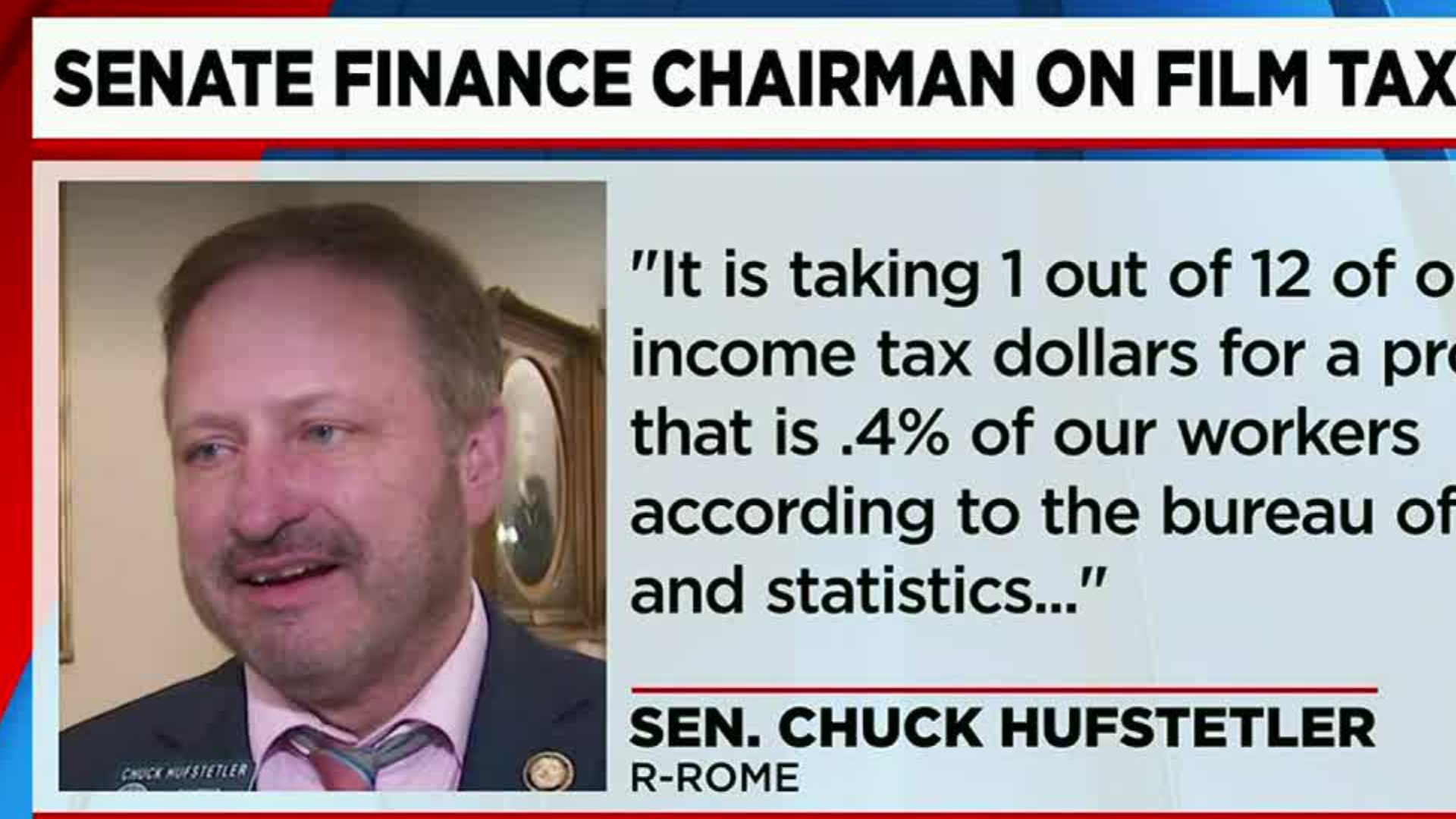

The credit includes various income and payroll credits but recently passed legislation makes several important changes. Hufstetler on Monday March 28 2022 unveiled a rewritten income tax cut proposal that would be more modest than the one sought by the House while also seeking to limit Georgias film tax. How-To Directions for Film Tax Credit Withholding.

Of the film tax credit 18-03A was released earlier this month. The big finding is that Georgias film incentive returned only 10 cents per dollar of tax credit given. CBS46 - A big development today in the effort to limit Georgias tax credit for the film industry.

We Work With The Best Brand Names In The Welding Industry Welding Supplies Welding Hobart Welder

Georgia S Film And Tv Tax Credit Hits Record 1 2 Billion In Reimbursements

/cloudfront-us-east-1.images.arcpublishing.com/gray/2N5YYBNUNBHP3AUVUVLPPODCH4.jpg)

Film Tax Credit Remains Intact After Changes Are Removed From Bill

Essential Guide Georgia Film Tax Credits Wrapbook

The 20 Most Incredible Houses In Movies Victorian Homes Old Houses Old Victorian House

Guest Essay Five Reasons Why Georgia Should Yell Cut On Film Tax Credit Arts Atl

Georgia Tax Breaks Don T Deliver Georgia Budget And Policy Institute

Incentive Solutions Incentive Sols Incentive Programs Incentive Travel Rewards

American Psycho How Patrick Bateman Changed Book Vs Film Youtube American Psycho Book American Psycho Book Of Changes

The Walking Dead Filming Locations Grant L Mitchell Park In Atlanta Ga From Season 1 Ep 1 Bicyc Walking Dead Series Walking Dead Tv Show The Walking Dead Tv

Civil War History Preservation Dallas Paulding County Ga Georgia State Parks Historical Sites Georgia Vacation

Psa Didn T Get A Stimulus Payment You Might Need To Do This In 2021 Child Tax Credit Tax Debt Irs

Essential Guide Georgia Film Tax Credits Wrapbook

Essential Guide Georgia Film Tax Credits Wrapbook

We Work With The Best Brand Names In The Welding Industry Welding Supplies Welding Hobart Welder

Film Tax Credit Remains Intact After Changes Are Removed From Bill

Lendio Leve 55 Millions De Dollars Pour Obtenir Des Prets Aux Petites Entreprises Grace Au Ma Small Business Loans Business Loans Machine Learning